Not too many seasons ago, domestic cricket tournaments felt pretty simple: organized matches, a hometown crowd, maybe a picture of a winning captain in the local paper. Then the Indian Premier League showed up, and everything changed. Now, IPL is the main stage for fans, stars, and advertisers. It’s an outsize show that rewrites every dollar guess, and by 2025, that story is even wilder.

IPL Valuation: Not Just About the Cricket Anymore

Let’s get something straight off the bat (pun intended) — the IPL isn’t just cricket. It’s Bollywood. It’s tech. It’s geopolitics. It’s Ambani, Shah Rukh Khan, Amazon, JioCinema, and more. The league has morphed into an economic organism with tentacles stretching from Jersey branding to crypto-integrated fantasy leagues.

The latest IPL valuation figures in 2025 are jaw-dropping:

- Total League Valuation: Estimated at $16.4 billion, up from $10.9 billion in 2022.

- Media Rights: Digital + TV bundled deals closed in 2023 brought in $6.2 billion over five years.

- Franchise Revenues: On average, a single team crossed the $150 million annual revenue mark in the 2024 season.

This isn’t growth. This is a gold rush with wickets.

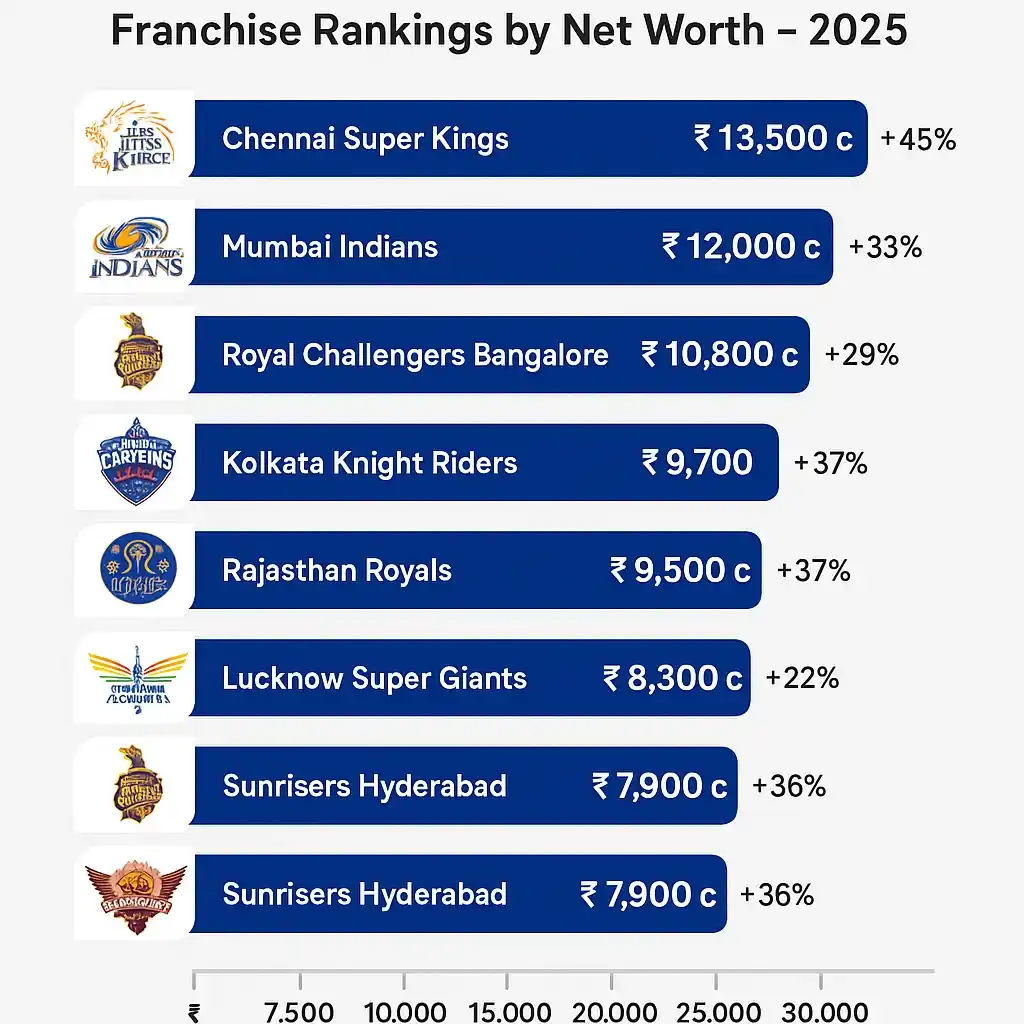

A Closer Look at Franchise Valuations (2025)

Below is a snapshot of franchise net worths this year, sourced from insider data and verified reports:

| Franchise | Estimated Valuation (USD) | Key Revenue Drivers |

| Mumbai Indians | $1.9 billion | Sponsorships, Merch, TV revenue |

| Chennai Super Kings | $1.8 billion | Fanbase loyalty, MS Dhoni factor |

| Kolkata Knight Riders | $1.6 billion | Brand leverage (SRK), Merchandise |

| Royal Challengers Bengaluru | $1.4 billion | Virat Kohli legacy, Global campaigns |

| Rajasthan Royals | $1.0 billion | Smart investments, US partnerships |

| Lucknow Super Giants | $950 million | Recent performance, local sponsors |

| Delhi Capitals | $920 million | Strategic ownership & media holdings |

| Sunrisers Hyderabad | $880 million | Consistent team structure |

| Gujarat Titans | $850 million | Fast-track branding, strong debuts |

| Punjab Kings | $800 million | Struggled with performance & identity |

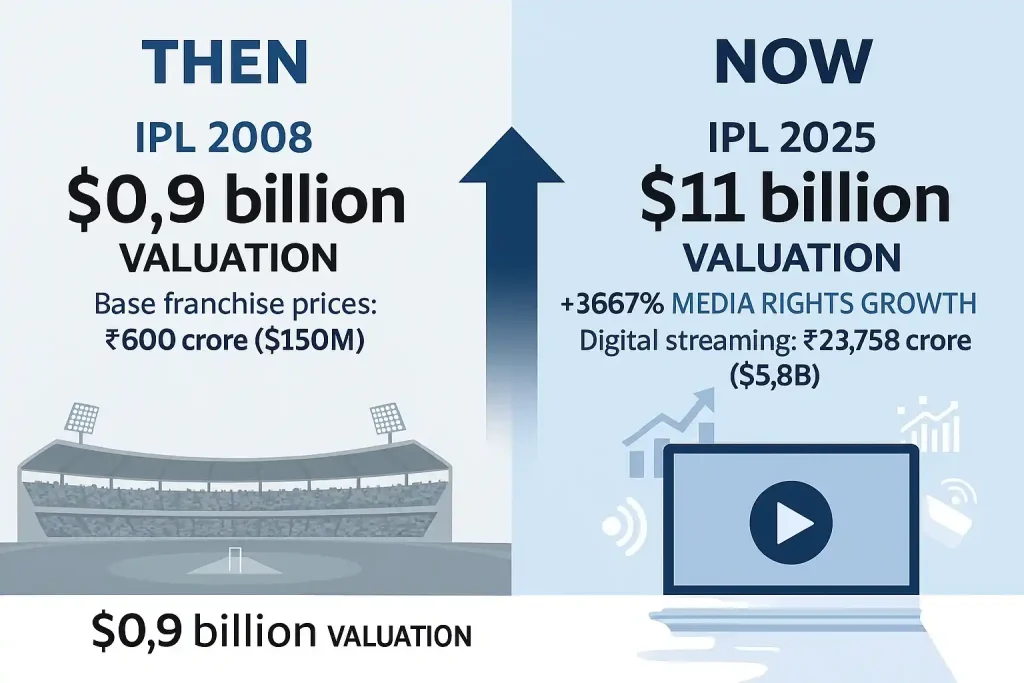

The Media Rights Boom — Fueling the IPL Valuation Engine

Remember the 2008 IPL? Sony Pictures had grabbed the inaugural TV rights for a cool $1 billion (that was huge back then). Fast forward to 2022–2027: Disney-Star and Viacom18 shelled out over $6.2 billion combined.

Digital took the front seat. JioCinema broadcast matches for free in 2023, disrupting paid streaming and banking on ad revenue like a Silicon Valley startup. It worked. It crashed records with over 35 million concurrent viewers during the 2024 final.

So, yes, the media rights valuation isn’t just a number on a balance sheet. It’s the jugular vein of IPL’s current business model.

Dream11, Fantasy Cricket, and the Valuation Loop

When Dream11 snatched the IPL title sponsorship in 2020, plenty of folks scratched their heads. A fantasy app putting its name on the league’s biggest stage? Fast-forward to 2025, and fantasy cricket is a massive $2.4 billion business in India. That deal turned out to be way more than just surface-level branding.

Every time someone builds a team, tunes into the game, and double-checks the scores, they create valuable action. More eyes on ads, longer time spent in the app, and a stickier user base happen with each game night. All that activity feeds straight back into the IPL numbers, making them more attractive when big sponsors come knocking.

Why Are Franchise Valuations So High?

Some wonder: they only play 14 matches a year — how is a team worth over a billion dollars?

Here’s the thing: franchises are media platforms now. They sell apparel, host podcasts, build apps, drop NFTs. CSK’s Dhoni content alone gets millions of impressions daily. KKR’s merchandise flew off shelves globally after their 2024 resurgence.

Also, IPL franchises now own teams in global T20 leagues — MI has franchises in South Africa and the UAE. It’s horizontal expansion that boosts parent valuation.

IPL vs. Other Leagues: A Global Comparison

| League | Year Established | Average Franchise Value | Media Rights Value |

| IPL (India) | 2008 | $1.3 billion | $6.2 billion (2022-27) |

| NFL (USA) | 1920 | $5.1 billion | $113 billion (11 years) |

| NBA (USA) | 1946 | $3.5 billion | $24 billion (9 years) |

| EPL (UK) | 1992 | $2.4 billion | $15.3 billion (3 years) |

| MLB (USA) | 1869 | $2.3 billion | $12.4 billion (7 years) |

No, IPL isn’t at NFL levels yet. But given its rise in just 17 years, the trajectory is unprecedented.

Private Equity & Institutional Money: What’s Driving It?

Big names, like CVC Capital, owners of the Gujarat Titans, and RedBird Capital, investors in the Rajasthan Royals, have turned Indian cricket into a boardroom show. They’re not cheering out of sheer love; they’re crunching numbers.

Their arrival lifts:

- Governance rules

- Sponsorship talks

- Media buzz

- Exit prospects- IPOs and sales

Owning an IPL team is now more than a game; it’s a line on the balance sheet.

The Elephant in the Room: Is This a Bubble?

Let’s ask the question every fan wonders: could the entire gig suddenly crash?

Could it? Sure. Is it on the radar today? Not really.

The key gap between IPL and, say, crypto hype, lies in hard assets. Stadiums, millions of screens, steady sponsorship checks, and even team-woven history give it weight. If ads drop for a season, the league won’t pack up overnight.

What might still put a dent in the value:

- New laws that choke fantasy leagues.

- Fans grow bored if matches stretch too far.

- Top players lose spark or retire in masse.

So, where are we now? The leagues are still soaring, and no pinhole has shown up yet.

IPL Valuation: Beyond Numbers, It’s a Cultural Currency

Every time a team shoots to the top of Twitter, every time a child sports a Rajasthan Royals tee in Dallas or Dubai, and every time an influencer lays out Dream11 picks, the leagues’ value rolls upward. It doesn’t gain more dollars; it gains more buzz.

This goes far beyond a game. It’s one of India’s hottest exports to the world.

So, the next time someone laughs at an IPL club being tagged at $2 billion, remind them that this talk isn’t really about cricket. It’s about owning the attention of millions. And heading into 2025, attention is the currency everyone wants.

Meet Arjun Kushaan, a passionate cricket analyst at The Cricket24x7. From street matches in his childhood to competitive college tournaments, cricket has always been a central part of Arjun’s life. With a strong background in data analysis and a natural affinity for numbers, he brings a fresh, analytical lens to the game. At The Cricket24x7, Arjun blends his deep love for cricket with his data-driven approach to deliver detailed insights and well-rounded coverage for fans of the sport.